The FANG stocks have said goodbye to roughly $88 billion in market cap this week. One strategist has a game plan for how to trade the acronym in case of more downside.

“Across the tech area, the one thing you’re going to be looking at is those February lows,” Miller Tabak equity strategist Matt Maley told CNBC’s “Trading Nation” on Tuesday. “If we break below those, it’s going to be a big problem. If they can hold them, it should be a much better situation.”

The XLK Technology ETF sold off in February to its lowest levels of the year as inflation fears spooked the broader market. It currently trades 6 percent higher than the intraday low of $60.97 set on Feb. 9.

One concern for Maley is that a contained chipmaker sell-off has spread to broader tech in recent days.

“A few days ago when we saw the semiconductors kind of roll over pretty hard … the rest of tech was holding up pretty well, whether it be the FANG stocks or the XLK tech ETF,” Maley said. “Now it’s those that have followed the semiconductor stocks lower, so that’s a concern.”

The XLK has not seen the severity of sell-offs the SMH VanEck Semiconductor ETF has endured since April 17, though losses have picked up speed. Since its April closing highs, the XLK has dropped 5 percent, while the SMH ETF has fallen 9 percent.

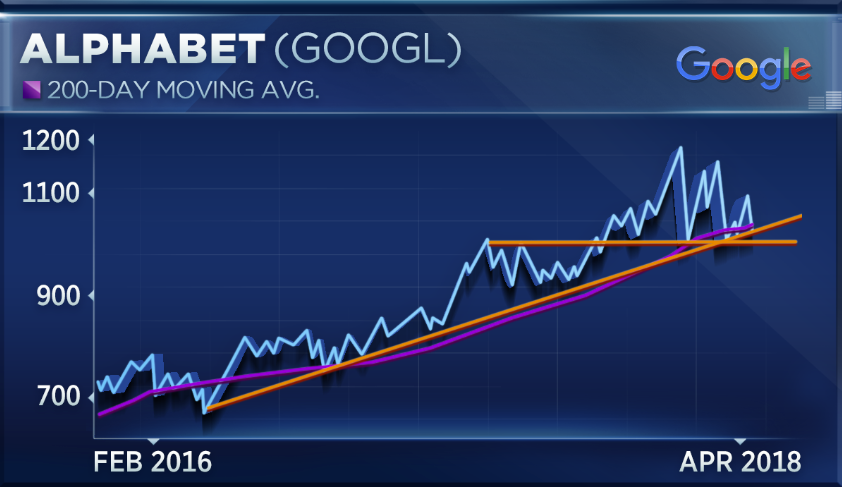

“If we look at Google, in particular; they reported earnings, it rallied [Monday night] initially but it’s rolled back over, and it’s broken its 200-day moving average and its trendline going back to 2016,” said Maley.

Alphabet closed below its 200-day moving average on Tuesday and is currently trading close to 1 percent below that support level. The Google parent posted an earnings and sales beat after the bell Monday.

“The key level is going to be the $1,000 level,” Maley added. “That was the old resistance level; now it’s become new support. If any kind of break below that, it’s going to be a big problem.”

For Stacey Gilbert, market strategist at Susquehanna, the longer-term fundamentals case for Alphabet remains intact. Her colleague, internet analyst Shyam Patil, has a positive rating on the stock with a $1,250 price target, implying roughly 21 percent upside from current levels.

“There are some positive catalysts out here, as Shyam would highlight, some of them being continued ads and, obviously, YouTube,” Gilbert said on “Trading Nation” Tuesday. “But, we do see this as a longer-term story because investors are concerned about the expenses.”

Activity on the options market suggests to Gilbert that there is still some hesitation surrounding Alphabet.

“There is not a ton of interest in investors coming in, stepping in, saying, ‘Listen, Alphabet is overdone, I want to buy it here on a pop,'” said Gilbert.

“Where we do see the most interesting flow is investors selling downside puts, what we would call underwriting, really drawing a line in the sand of where they’re comfortable getting into Alphabet if it were to pull back,” Gilbert said.

Alphabet shares are down 2 percent in the year to date, around double the losses on the S&P 500. It remains nearly 16 percent higher over the past 12 months.