Retirement Planners of America senior planner Ken Moraif on today’s markets and investing in tech.

Tech stocks were set to open sharply lower Monday morning as bond yields climbed after the Senate passed President Biden’s $1.9 trillion COVID-19 relief package.

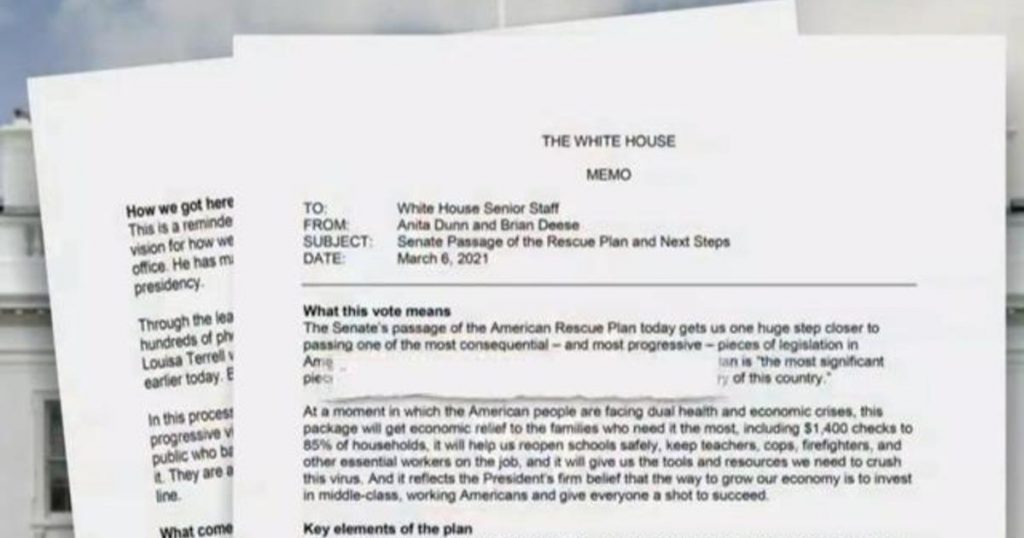

In a 50-49 vote, the Senate passed its own version of Biden’s $1.9 trillion bill, which limits $1,400 checks to those making $75,000 a year or less and strips out a $15 minimum wage, among other things. The U.S. House of Representatives will vote on the measure as early as Tuesday.

The bill’s passage through the upper chamber reignited worries of inflation, sending the 10-year Treasury yield up 5 basis points to 1.60%.

HOME CONSTRUCTION MAY HIT SKIDS AS NEW SUPPLY SHORTAGE LOOMS

Nasdaq futures were down 1.61% while S&P 500 futures were down 0.72%. Dow Jones Industrial Average futures slipped 0.19%.

In stocks, mega-cap technology shares were set to open lower as rising bond yields threatened their growth outlooks.

Elsewhere, Microsoft Corp. shares were in focus after a cyberattack on its Exchange email software, believed to be carried out by Chinese hackers, infected tens of thousands of customers.

Walt Disney Co. will reopen its California theme park at reduced capacity beginning April 1.

Meanwhile, GameStop Corp. shares rallied after Chewy founder Ryan Cohen has been tasked with leading the company’s e-commerce shift.

In mergers and acquisitions, General Electric Co. is nearing a deal worth more than $30 billion deal to combine its aircraft-leasing business with Ireland’s Aercap Holdings NV, according to The Wall Street Journal, citing people familiar with the matter.

Apollo Global Management agreed to retirement services company Athene Holdings for $11 billion in stock. The deal, which pays a 17% premium to Athene’s closing price on Friday, gives shareholders 1.149 Apollo shares for each Athene share they own.

In commodities, Brent crude oil reached $71.38 per barrel overnight after Yemen’s Houthis launched a drone attack on Saudi Arabia’s oil facilities. Prices have since pulled back with Brent trading up 25 cents at $69.61 per barrel. West Texas Intermediate crude oil, meanwhile, gained 27 cents to $66.36 per barrel.

Elsewhere in the commodities complex, gold fell $15.40 to $1,683.10 per ounce.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Overseas markets were mixed.

In Europe, Germany’s DAX 30 was trading higher by 1.3%, France’s CAC 40 gained 0.78% and Britain’s FTSE 100 advanced 0.21%.

Asian markets, meanwhile, were under pressure with China’s Shanghai Composite index declining 2.3%, Hong Kong’s Hang Seng index falling 1.92% and Japan’s Nikkei 225 losing 0.42%