Increased commitment from mom-and-pop investors has some Wall Street market pros wondering whether the bull market is showing its age.

Retail participation is considered a classic late-stage sign of a market rally — the capitulation of the last bears is generally indicative that there’s not much money left to be put to stocks and that it’s probably a good time to get out.

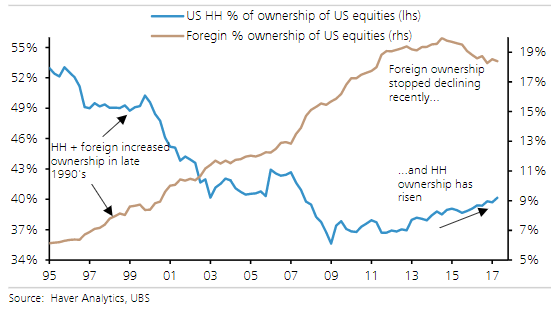

UBS strategist Keith Parker is looking both at retail buyers and foreign investors as a gauge to how close the bull run is coming to an end. Parker sees the two groups as “driving the last phase of the bull market,” which could entail another significant lift for share prices, providing Congress passes tax reform.

“In a world flush with liquidity but with less trading liquidity, positioning and flows have and will matter more, particularly around key catalysts like a tax cut,” Parker said in a note to clients. “The improvement in US economic data the last 3 months supports the ~7% rally on its own, suggesting positioning is not excessive and a tax cut is also not fully priced.”

Increases in household and foreign money often has coincided with the risk in markets, staying low in the early phases and peaking at the end.

“Historically, we believe that retail and foreign buyers are typically the marginal buyer during the last phases of a bull market,” Parker added. “Indeed, we see that US households have been increasing their ownership of US equities (ex (mutual funds), ETFs, pensions), which has happened at the end of prior cycles.”

Parker points out that in Asia there is some $40 trillion in sideline cash, far above the level in the U.S. Signs that the money is being directed to the U.S. market would indicate that a longer-term top could be setting in.

UBS retains a pretty optimistic view on the market, at least for the year ahead. In fact, the firm said that in a best-case scenario that includes passage of tax reform and the earnings benefits it should bring, the S&P 500 could climb to 3,300 by the end of 2018. That would translate to a 25 percent gain from the index’s current level.

In some ways, though, it seems like retail investors are just getting in on the action, after years of sitting out the nearly 300 percent surge in the S&P 500 since March 2009.

For instance, exchange-traded funds that focus on stocks have taken in nearly $300 billion in 2017, more money than all of the $3.4 trillion industry has seen in all asset classes for any given year, according to State Street Global Advisors.

ETFs long have been an instrument for professional traders, but ownership has shifted recently to where nearly half the funds are owned by retail investors.

Yet there seems to be room to run.

Sentiment has been improving but still in check. The American Association of Individual Investors’ most recent survey showed bullishness at 35.9 percent against 2.6 percent for bears. The survey asks investors where they think the market is heading in the next six months; optimism was 2.4 points below its historical average, while pessimism was 1.1 points above trend.

“While the continued rise of the major U.S. stock indexes into record territory is encouraging to some individual investors, many others have previously expressed concerns about the possibility of a pullback or a more severe drop occurring,” Charles Rotblutt, AAII Journal editor, said in a statement. “Tax reform could also be playing a role.”

Professional investors, meanwhile, are much more bullish.

The Investors Intelligence survey this week showed bulls at 64.2 percent against 15.1 percent for the bears. The bullish level, and the spread between the two camps, is near the Black Monday level in 1987. Such high levels of optimism often are contrarian signs for the II survey.

WATCH: A Bank of America Merrill Lynch strategist believes the rally is getting winded.