Markets are more or less shrugging off the potential for a government shutdown, even though the odds for a closure seem higher than the last time Congress temporarily extended spending authority.

Goldman Sachs economists on Thursday put 35 percent odds on a shutdown, higher than usual, as Congress and the White House posture around a continuing resolution ahead of Friday’s deadline.

“The more likely outcome appears to be a short-term extension of spending authority to avert the shutdown,” Goldman economists wrote in a note. The current proposal would set the next deadline at February 16. “This would actually increase the risk to financial markets, as it would put the next spending deadline closer to the debt limit deadline, which could come sometime between late February and late March.”

Stocks were mixed after the Dow earlier reached a record high. The Dow was off 47 points in afternoon trading while the Nasdaq and S&P 500 were both slightly higher. In the bond market, yields were higher at the long end of the curve and under pressure in the 2-year and 3-year sectors.

Analysts said the market could react if there is a shutdown, but they don’t expect a major sell off. “If the government closes, it will soon reopen,” said Peter Boockvar, chief investment officer, Bleakley Financial Group. “The market could care less.”

The Goldman economists said the shutdown could have a slight impact on first quarter GDP, slicing off a 0.2 percentage points of growth for every week that goes by. But any hit would quickly be made up and reverse in the next quarter.

“If you go back and look at all the past shutdowns, they don’t impact economic activity,” said John Briggs, the head of strategy at NatWest Markets. “The only time markets get really worried is when the debt ceiling is tied to it, and that’s not the case this time.”

Art Hogan, chief market strategist at B. Riley FBR, noted that the feuding appears to be between Republicans rather than between Democrats and the GOP. The House is talking about voting on a resolution, but Senate leadership is talking about plans in the event of a shutdown.

“We see a chance of getting this resolved,” Hogan said. “There’s a rising frustration level. We didn’t take this seriously, and now it’s Friday’s business.”

He said a second concern for the stock market is the move higher in the 10-year yield. “There is a point of pain tin the yield on the 10-year . This is the level where everybody gets concerned.”

The 10-year Tresaury was yielding 2.60 percent in afternoon trading, and traders were watching to see if it would move to the key technical level of 2.63 percent, a high from 2016. If that level is broken, traders expect the 10-year to move higher. The yield affects a whole range of lending rates, including mortgages.

“Every time you kick the can down the road, there’s a unintended consequence,” Hogan said. “The further you push this out, the more complicated it gets.”

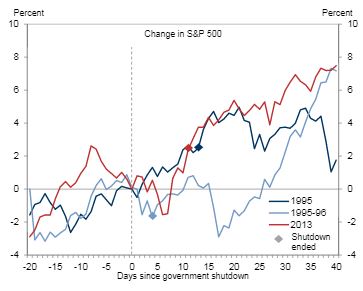

The Goldman economists said markets have tended to shrug off shutdowns as long as the debt limit is not involved. Three prior shutdowns —1995, 1995-96 and 2013 — had a modest effect on financial markets.

“The dollar weakened slightly in all three cases in the few days following each shutdown, with a further leg down in 2013 as the debt limit deadline approached. Treasury yields did not react meaningfully at the start of these shutdowns.The equity market reaction was inconsistent, with a slight decline in the early days of the December 1995 and October 2013 episodes, but no real change around the November 1995 shutdowns,” the Goldman economists noted.

Even with a squishy stock market, strategists said the market was not paying much attention to Washington on Thursday.

“This market is trying not to see anything until the bad news is on the tape, and then it’s not sure wants to sell it,” said Michael O’Rourke, chief market strategist at JonesTrading. “It’s been pretty teflon, pretty remarkable.”

Source: Goldman Sachs