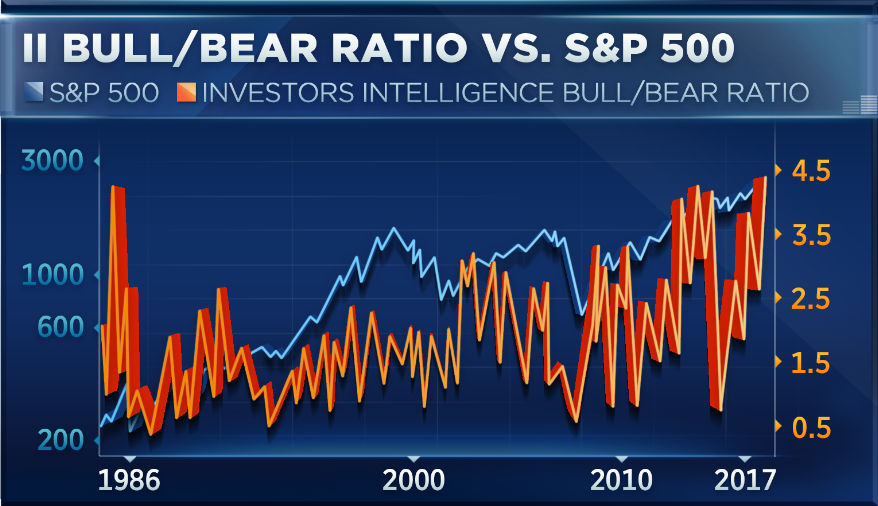

By one measure, investors are the most optimistic they’ve been in 30 years, and that could be a bullish sign of what’s to come for the markets.

The Investors Intelligence bull/bear ratio, which measures the level of optimism in the markets, has reached its highest level since 1987 as the markets have broken record after record this year. According to Oppenheimer technician Ari Wald, that could set the stage for another leg higher.

“The bears would counter right that there’s too much optimism in the market. … It sounds scary but what they’ve failed to report is that the S&P [surged] another 23 percent when it first reached that level in 1987, before reaching that final top,” Wald said Wednesday on CNBC’s “Trading Nation.”

“So we’ve seen historically, markets able to rally through optimistic conditions until the internal divergences emerge. Right now we don’t see those glaring warnings, we think the uptrend continues.”

Furthermore, Wald pointed to global equities as confirmation that the bull market remains intact, calling the rally in overseas markets “a very key piece of bullish evidence.” This week, Japan’s Nikkei rallied to its highest levels in 21 years, while the German DAX hit an all-time intraday high on Wednesday. This while emerging markets have continued to surge, with the EEM ETF now up 33 percent this year.

“The market [is] behaving in a manner that’s consistent with the middle innings of a healthy bull market,” he said.

The S&P 500 was in negative territory on Thursday, putting it in danger of snapping its longest losing streak in three years, but even in the event of a pullback, Bill Baruch, president of Blue Line Futures, says investors need not worry.

“If we pullback here I do think we will recover very quickly, and I ultimately think that we will finish the year higher than where we are right now, closer to 2,600,” he said on “Trading Nation.”

Now this pullback could occur, according to Baruch, if the Republican tax plan isn’t met with enthusiasm, which seemed to be the case after the initial Thursday morning release. But ultimately, Baruch believes that momentum in the current market could prevail.

“The market broke out of this 10-year trend above 2,507, and I think it has a tremendous amount of momentum,” Baruch said, adding that he does expect “the Santa Claus rally into December to help this market finish on a positive note.”

With Thursday’s drop, the S&P was lower for the first time in three trading days, while the Nasdaq was down for the fifth time in seven trading sessions. The Dow continues to bounce between gains and losses, though the index is still positive for the week.

Correction: Bill Baruch is president of Blue Line Futures. An earlier version misstated his title and firm.