Although interest rates have risen over the past few months, some borrowers may still be able to lock in a lower monthly payment with student loan refinancing. (iStock)

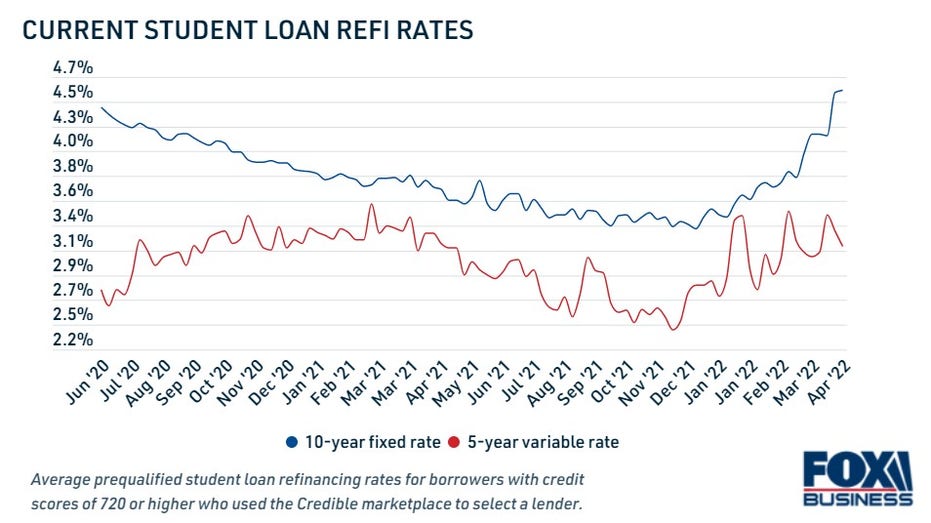

The Federal Reserve has begun implementing a series of interest rate hikes planned for 2022 in an effort to combat record-high inflation. As a result, private student loan interest rates have risen this year, according to Credible data.

Despite the current rate environment, some student loan borrowers may still reap the financial benefits of refinancing to a lower interest rate. Student loan refinancing may help you pay off debt faster, reduce your monthly payments and save money in interest charges over time. Here’s how to determine if you should refinance your student loan debt:

Read more about each step in the sections below, and you can visit Credible to compare student loan refinance rates for free without impacting your credit score.

HOW MUCH ARE STUDENT LOAN PAYMENTS?

Determine if you’ll benefit from federal loan programs

When deciding if you should refinance, it’s important to consider the type of student loans you have. Refinancing your federal student loan debt into a private loan would make you ineligible for select government protections, including:

- Income-driven repayment plans (IDR). Federal student loan borrowers may be able to enroll in an IDR plan to limit their monthly payments to a certain percentage of their income, depending on family size. After a repayment term of 20 or 25 years, the remaining loan balance is forgiven.

- Student loan deferment and forbearance. The Department of Education offers a number of debt relief programs for borrowers experiencing financial hardship, including deferment. Plus, most federal borrowers are currently in COVID-19 administrative forbearance through September.

- Federal student loan forgiveness programs. Private student loans aren’t eligible for federal student debt cancellation measures, like the Public Service Loan Forgiveness program (PSLF), borrower defense to repayment and closed school discharges.

But if you already have private student loan debt that doesn’t qualify for these programs, then you don’t have as much risk by refinancing. And if you don’t plan on utilizing these federal benefits, then refinancing to a private loan may be worthwhile. You can learn more about student loan refinancing by getting in touch with a knowledgeable expert at Credible.

WHAT TO KNOW ABOUT STUDENT LOAN CONSOLIDATION

Compare your student loan rate to current interest rates

While student loan refinance rates have risen slightly over the past several months, current rates may still be lower than they were when you first borrowed your college debt.

A Credible analysis found that the average federal student loan rates from 2006 through 2022 were 4.60% for undergraduates, 6.16% for graduate students and 7.20% for graduates or parents who borrowed PLUS loans. In comparison, the average private student loan rate for the 10-year term was 4.59% during the last week of April 2022.

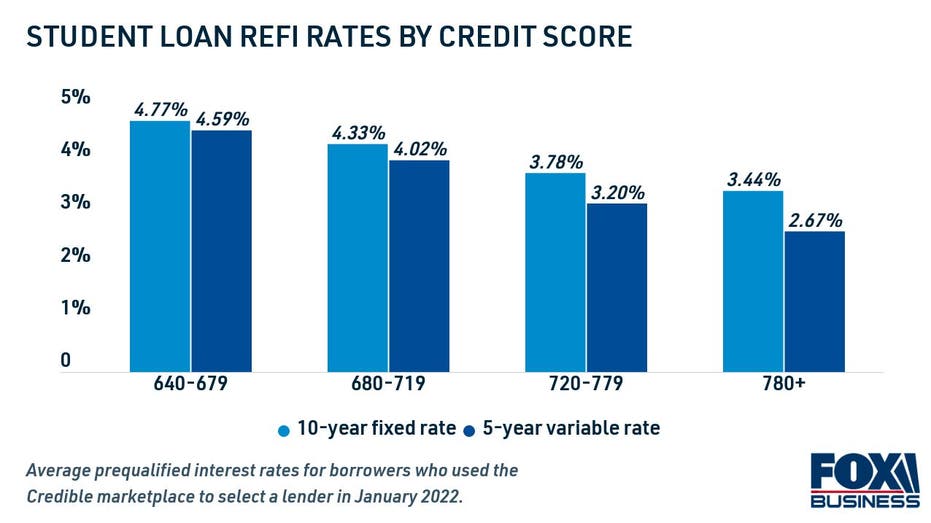

Furthermore, private student loan rates are determined in part based on a borrower’s credit score and debt-to-income ratio (DTI). Applicants with excellent or very good credit typically qualify for much lower interest rates than those with fair or bad credit. Those with a limited credit history may get a lower rate by refinancing with a creditworthy co-signer, such as a trusted friend or relative.

Private lenders let you get prequalified to see your estimated student loan refinance rate with a soft credit check, which won’t harm your credit score. You can visit Credible to prequalify through multiple lenders at once, allowing you to shop for the lowest rate possible for your situation.

WHO IS MY STUDENT LOAN SERVICER?

Use a student loan calculator to estimate your savings

Once you’ve determined your current student loan rate and the estimated rates you prequalified for, you can use a student loan refinancing calculator to determine if this debt repayment strategy is worthwhile. You can use Credible’s student loan calculator to estimate your new monthly payment and total interest paid over the loan term. That way, you can estimate your potential savings by refinancing your student loan debt.

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.