Shares in Hong Kong plummeted Wednesday morning as they returned from a holiday amid coronavirus fears.

The Hang Seng index dropped almost 3% in early trade, before last declining 2.49%.

Hong Kong-listed shares of travel-related firms plummeted. China Eastern Airlines plunged 5.54% and China Southern Airlines dropped 5.36%. Insurance stocks also took a hit, with life insurer AIA declining 1.87% and Hong Kong-listed shares of China Life Insurance falling 4.27%. Meanwhile, gaming stocks dropped as Wynn Macau dove 4.11% and Melco International Development fell 4.75%.

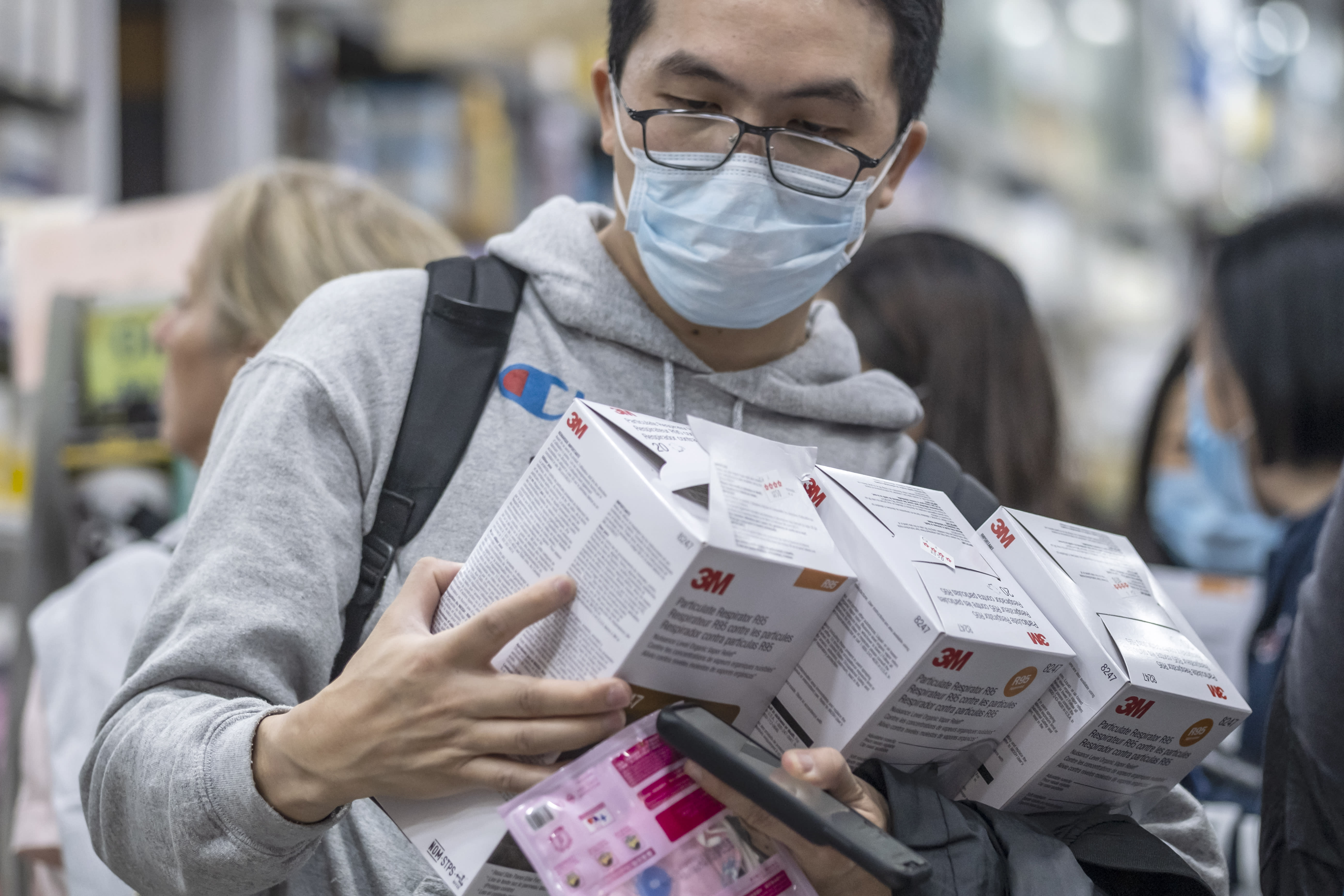

Hong Kong leader Carrie Lam on Saturday declared a virus emergency in the city of 7.3 million, extending school cancellations until Feb. 17 and canceling all official visits to mainland China. The ongoing virus outbreak has killed more than 100 in China, according to Chinese health officials. The number of infected in China has also now surpassed that of SARS.

Lam announced a package of measures aimed at limiting the Asian financial hub’s connections to mainland China. Flights and high speed train journeys between Hong Kong and the Chinese city of Wuhan will be halted, and annual official Lunar New Year celebrations for the city have been scrapped.

Markets in China remain closed on Wednesday for a holiday.

In other Asian markets, Japan’s Nikkei 225 was up 0.54% while the Topix index gained 0.25%. South Korea’s Kospi also added 0.63%.

Stocks in Australia rose, with the S&P/ASX 200 up 0.64%.

Overall, the MSCI Asia ex-Japan index traded 0.43% lower.

Apple suppliers mixed

Overnight stateside, the Dow Jones Industrial Average surged 187.05 points to close at 28,722.85. The S&P 500 advanced 1% to end its trading day at 3,276.24. The Nasdaq Composite advanced 1.4% to close at 9,269.68.

Amid the coronavirus fears, the White House told airlines that it may suspend all flights from China to the U.S., according to people familiar with the matter.

“Even if this strain of Coronavirus may be deemed less potent than SARS, there is no excuse for complacency given risks that proliferation is likely amplified by far more extensive travel in and out of China compared to (the) SARS period,” Vishnu Varathan, head of economics and strategy at Mizuho Bank, wrote in a Wednesday note.

“In all likelihood, rising infection and casualty count into the day and over the next few days and weeks will strain some of the relief moves we have seen overnight,” the economist said.

Currencies and oil

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 97.991 after seeing an earlier low of 97.943.

The Japanese yen traded at 109.19 per dollar after weakening from levels below 109 yesterday. The Australian dollar changed hands at $0.6765 after rising from levels around $0.674 yesterday.

Oil prices rose in the morning of Asian trading hours, with international benchmark Brent crude futures up 0.96% to $60.08 per barrel. U.S. crude futures gained 0.9% to $53.96 per barrel.

— CNBC’s William Feuer contributed to this report.