Safety trades are smoking hot.

While investors largely sold out of domestic and international equities in August amid a broader push for protection, several key safety trades in the exchange-traded fund market saw huge inflows.

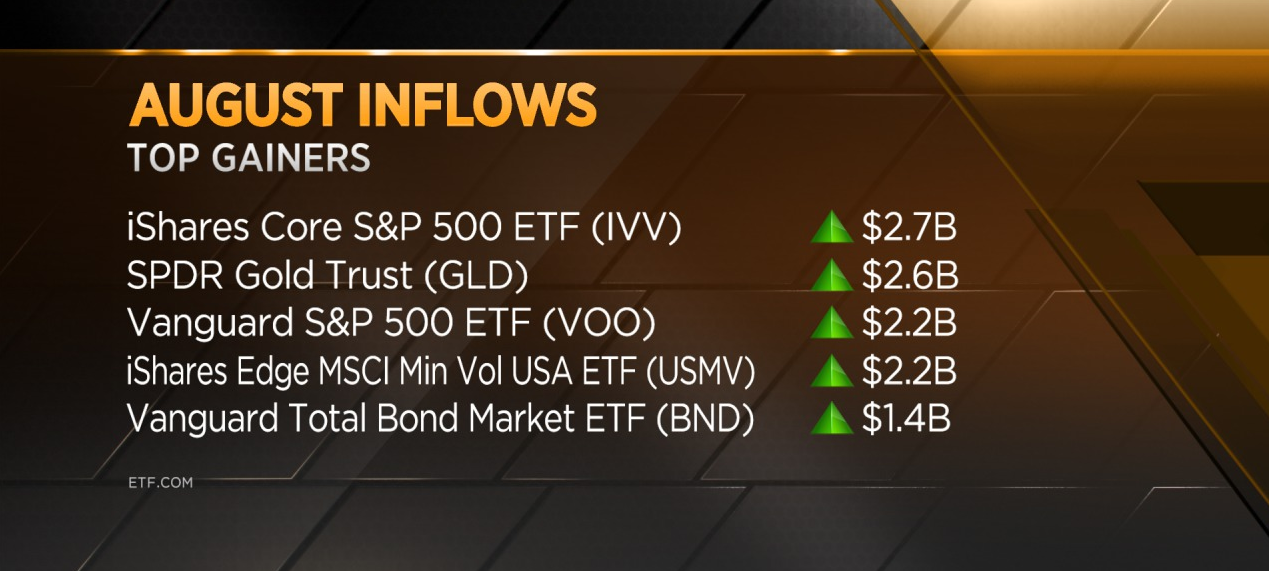

The iShares Core S&P 500 ETF (IVV), the SPDR Gold Trust (GLD), the iShares Edge MSCI Minimum Volatility USA ETF (USMV) and the Vanguard Total Bond ETF (BND), all of which represent buyers’ search for safety in a volatile market, were among the biggest net gainers in August.

Also on the winners’ list was the Consumer Staples Select Sector SPDR Fund (XLP), with more than $1.3 billion in inflows. XLP closed at a new all-time high Wednesday.

But not all these winners are necessarily safe to buy, experts say. With lofty valuations and slim profit margins, consumer staples plays in particular could pose unwanted risk to investors, according Dave Nadig, managing director at ETF.com.

“A lot of people are looking at those consumer staples stocks,” Nadig said Wednesday on CNBC’s “ETF Edge.” “I get nervous about leaning hard into consumer staples because the definition isn’t what we think it is. It’s tobacco. It’s retail. I think people should be looking at other ways to play defense.”

Moreover, the traditional sector-picking approach feels “misguided” in this volatile, rules-bucking market, Nadig said.

“I would be looking for stocks that exhibit low beta to the market, or that you know historically are going to perform reasonably well in a downturn,” he said. “The Invesco Defensive Equity ETF, [ticker] DEF, is one way to play that.”

Steve Grasso, managing director of institutional trading at Stuart Frankel, didn’t see any harm in sticking with what’s working.

“I think you throw out fundamentals. Unfortunately and fortunately, as a trader, you get to throw out fundamentals when you want,” he said in the same “ETF Edge” interview.

“For me, the story is go with what’s working because nothing has changed,” Grasso said. “I don’t have any edge on Brexit. I don’t have any edge on China trade. And I don’t have any edge on the Fed right now. So, I have to go with what has performed, and those are the safety bets and gold.”

Those safety plays also include utility stocks, which both Grasso and Nadig said would be attractive if stocks see a prolonged drop.

“Just think about it: a utility is going to do better during a recession. They can pass on those rates to the clients that they serve, or, during good times, it’s also going to do well,” Grasso said. “So, I think that they are safety bets. I do think that they can extend their gains for the year.”

For Nadig, utilities are as good a bet as any considering investors’ recent exodus from the bond market.

“We’ve seen huge outflows in things like corporate bonds. Investors are not looking there for their yield plays anymore,” Nadig said. “I think utilities, if you’re looking for yield, continues to be a great way to do that. I think high-yield stocks in general are probably a good place to be if we see a sustained downturn.”

Nadig also warned investors not to get ahead of themselves by making poor buying and selling decisions, including on whether to chase the year’s new top-performing sector: real estate.

“The wrong thing to do as we start seeing some of this negative economic data is to pull the rip cord and say, ‘I’m just going into cash,'” he said. “Investors are terrible at making those kinds of timing decisions. I would argue chasing something like real estate because it’s had a good quarter [is] also a terrible timing decision for most investors.”

Disclosure: Stuart Frankel & Co. has a position in GLD.