Once a battleground for retailers and shoppers alike, Black Friday may be entering a “ceasefire” as more customers look for deals online, according to one Wall Street analyst.

Research from Jefferies finds that only 13 percent of consumers say they’ll be spending more this Black Friday, down from 17 percent from last year. The trend may signal an ongoing shift away from Black Friday to the rest of the month.

Analyst Daniel Binder was “surprised” by some of the Jefferies survey findings.

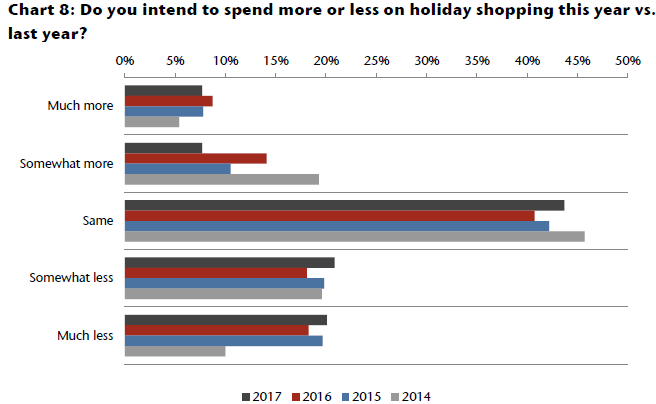

“Although many consumers have similar shopping budgets as last year, we were surprised that those saying that had more to spend was lower year over year, while those having less to spend was in line with last year’s survey,” wrote Binder in a note to clients Wednesday. The analyst said that low-cost plays like Wal-Mart are likely set for the best performance this holiday season.

Source: Jefferies

“We have seen retailers such as Best Buy and Walmart take price out of the equation for consumers as they have matched, or cut prices below Amazon,” wrote Binder on Wednesday. “Our analysis of the Black Friday ad showed Walmart is offering a slightly smaller average discount this year, particularly in TVs, computers/tablets and video games/consoles.”

According to the Jefferies survey, Amazon remains the top destination for increased spending, just ahead of second-place Wal-Mart. To be sure, the analyst still projects 3.5 to 4 percent total holiday sales growth, higher than last year.

As Jefferies’s favorite name for the holiday season, Wal-Mart has been hard at work to improve its online presence and shipping speed in response to pressure from e-commerce giant Amazon. Even from an economic stance, noted the analyst, Wal-Mart may be well positioned to take advantage of stronger wage growth among low income households.

Shares of Wal-Mart traded down 1 percent in early Wednesday trade.

“Following our upgrade of Wal-Mart in June 2016 we have continued to see the company make good progress on store conditions and online, and customers have responded,” continued Binder. “This has included greater assortment; better price management; 2-day shipping (or less); buy grocery online, pick up in store; and the acquisition of jet.com and other specialty operations.”

But for the bigger picture, Binder also sees some longer-term trends evolving.

For one, the relentless Black Friday “arms race” between retailers seems to be at a ceasefire, with JCPenney being the only company in Jefferies coverage opening earlier this year.

The ongoing shift to online sales has been accompanied by a shift from Black Friday to Black November, with discount deals emerging earlier and earlier in the month. The rising omni-channel preference could be beneficial to physical retailers given that multi-channel shoppers tend to spend more.

“Black Friday isn’t as special as it used to be,” concluded Binder. “Once again, we have seen many retailers come out with pre-Black Friday deals this year. This is part of a multi-year trend and we expect it to continue in the coming years with greater intensity, just as we saw this year.”

“With only so many dollars for consumers to spend, we are not necessarily convinced this will help total holiday sales.”