Circle Squared Alternative Investments founder and CIO discusses the long-term impact of rate hikes on the U.S. economy on ‘Varney & Co.’

The Federal Reserve is set to announce another hefty interest rate hike on Wednesday as it battles to tame stubborn inflation that began as the U.S. emerged from the COVID-19 pandemic and accelerated following Russia’s invasion of Ukraine.

However, several other central banks across the globe are facing the same problem and responding in kind with rate increases of their own, sparking fears that the simultaneous moves could lead to a global recession.

The Federal Reserve and several central banks across the globe are expected to raise interest rates this week. (AP Photo/Patrick Semansky, File / Associated Press / AP Images)

Wall Street and economists widely expect Fed policymakers to announce a three-quarter percentage point boost of its own on Wednesday, which would be the third mega-sized 75-basis-point jump in a row and the fifth U.S. rate hike for the year.

The European Central Bank raised interest rates by 75 basis points earlier this month up from zero, in what was the central bank’s highest increase ever as it upped its inflation projection to average 8.1% for the year.

ANOTHER JUMBO FED RATE HIKE POISED TO ADD $2.1T TO NATIONAL DEBT, CRFB SAYS

Sweden’s central bank, Riksbank, raised interest rates Tuesday by a full percentage point to 1.75% in an attempt to fight back inflation, which reached a three-decade high of 9% in the country last month.

The increase was higher than expected, and officials warned further boosts are coming this year.

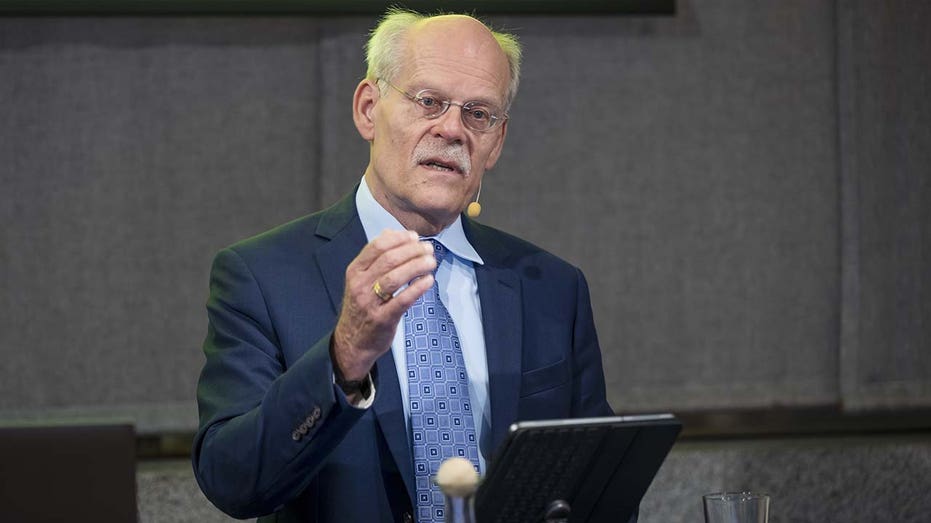

Stefan Ingves, governor of the Sveriges Riksbank, during a news conference following a policy rate decision in Stockholm, Sweden, on Thursday, June 30, 2022. (Photographer: Mikael Sjoberg/Bloomberg via Getty Images / Getty Images)

“When rates go up, obviously, interest costs go up for many households, but the costs of high inflation – persistently high inflation – those are, in fact, even bigger,” Governor Stefan Ingves told reporters.

“By raising rates now and by continuing to hike rates we reduce the risk that inflation is going to park itself at a high level.”

The Bank of England also meets this week, as do the Bank of Japan, Swiss National Bank and Norway’s Norges Bank.

BILLIONAIRE RAY DALIO WARNS STOCK COULD PLUNGE 20% IF INTEREST RATES RISE TO 4.5%

Traders expect the U.K. to announce a 75-basis-point boost to 2.5%, as the country battles 9.9% inflation despite already implementing a half dozen rate hikes this year.

Analysts anticipate the Bank of Japan will keep rates near zero. The country’s consumer price index spiked at the fastest annual rate in nearly eight years in August to 2.8%.

The Swiss National Bank is expected to approve a 75-basis-point hike after increasing its inflation forecast to rise by 3% this year, up from an earlier 2.5% projection.

Economists polled by Reuters expect Norges Bank to lift rates by 50 basis points as Norway battles 6.5% year-over-year inflation.

World Bank President David Malpass attends the UN Climate Change Conference in Glasgow, Scotland, Nov. 3, 2021. (REUTERS/Yves Herman / Reuters)

The ongoing trend of central banks across the globe tightening monetary policy is setting off alarms at the World Bank, which warned last week that if the trend continues it could drag the global economy into a recession.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“Global growth is slowing sharply, with further slowing likely as more countries fall into recession,” said World Bank Group President David Malpass. “My deep concern is that these trends will persist, with long-lasting consequences that are devastating for people in emerging markets and developing economies.”

FOX Business’ Megan Henney and Reuters contributed to this report.