Wall Street’s New Year’s party kept the corks popping on Thursday, with the Dow Jones industrials crossing the 25,000 level for the first time. As with each crossing of such a big-number marker, the question again is: Can this soiree keep swinging? There’s reason to doubt that it can.

Nothing in particular sparked the latest milestone crossing. Instead, it seems to be a continuation of no-volatility, no-drama uptrend that was 2017’s hallmark. And it came just one day after the Nasdaq Composite vaulted the 7,000 threshold.

The Dow posted its latest 1,000-point gain a mere 23 calendar days after the move above 24,000 on Nov. 30, the fastest 1,000-point jump ever (chart below). On a percentage basis, that’s the fourth-fastest gain.

The flip side of this is the absolute lack of volatility. The CBOE Volatility Index — known as Wall Street’s fear gauge — fell to around 8 for the second day in a row — another stock market first. Before 2017, the VIX fell this low only once, in 1993.

Remember, however, that a rise in inflation driven by higher wages is the linchpin that threatens to undermine this dynamic. And it could be coming soon.

As demand for labor keeps climbing, hourly wages have nowhere to go but up — they continued to trickle higher in the payroll data released Friday, rising to a 2.5 percent pace in December from 2.4 in November. That rate could accelerate notably anytime soon.

Moreover, the persistent rise in energy prices — sparked by harsh U.S. winter conditions and fears over Iranian supply given popular unrest there — means crude oil will start fueling overall inflation levels in a way that hasn’t been seen in years.

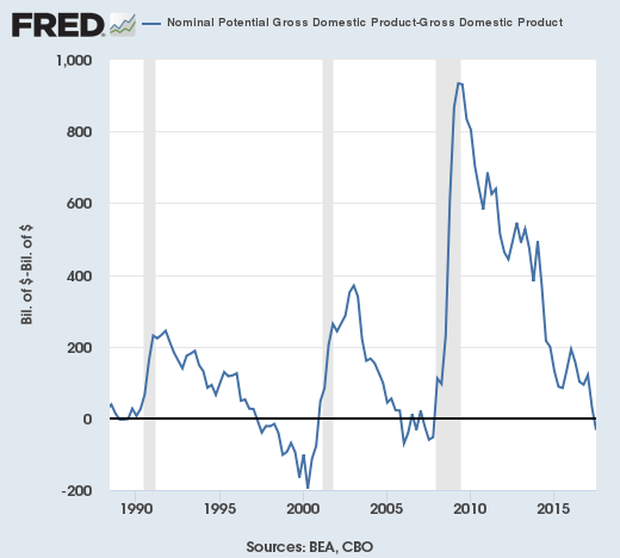

All together, that means the Federal Reserve’s pace of 2018 rate hikes could be more aggressive than is widely assumed. Especially because the gap between actual U.S. GDP and potential GDP has finally closed for the first tine since the financial crisis (chart above). So the economy is now operating above its natural “speed limit” and thus increasing the chances that inflation will accelerate.

On that subject, Bank of America Merrill Lynch analysts recently noted a regime shift as of late, with bond market expectations moving toward the Fed’s more aggressive estimates, not vice versa. Should this trend continue, investors will need to price in another two rate hikes over the next two years (the current gap in expectations).

Especially with makeup of the Fed’s policymaking committee set to turn hawkish this year with new voters in the rate-setting group and the retirement of current Chair Janet Yellen. In other words (famous on Wall Street): “Don’t fight the Fed.”

Analysts at SentimenTrader noted that the market’s breathless rise means it has been nearly 400 days (or more than 450 if we exclude a single day last June) since the major indexes were more than 5 percent off a 52-week high. The three other times this happened, a decline of more than 7 percent in the S&P 500 happened over the next 30-40 days.

This comes at a time when individual investors are already holding their highest stock exposure since 2000 — and yet their short-term optimism is rising. It just hit the second-highest level since the 2009 low, according to the AAII Bull Ratio.

Moreover, seasonality and market history point to headwinds for stocks in the second half of January. The folks at Almanac Trader recently note that 10 of the last 18 years featured nasty declines in that period — especially in midterm election years, like 2018.

Tread cautiously.

© 2018 CBS Interactive Inc.. All Rights Reserved.