Investors need to be careful on small-cap names heading into 2018 despite better-than-expected performance this year, according to Jefferies.

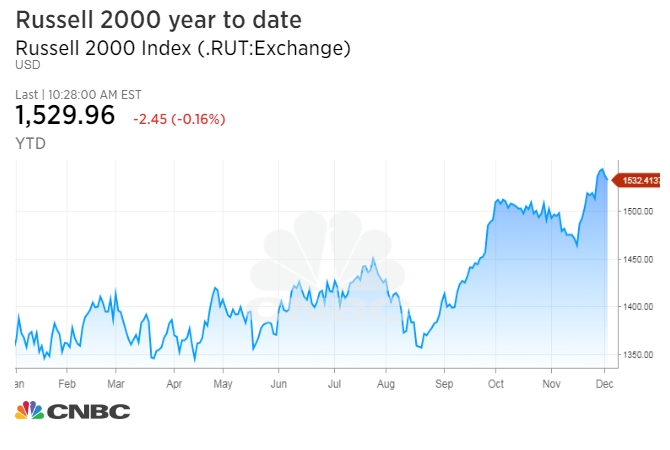

Though strategist Steven DeSanctis admits he was “way too conservative” with his 1410 Russell 2000 target, he isn’t necessarily changing his wary views.

“We see another year of low returns for small with the Russell 2000 rising to 1664,” DeSanctis explained to investors Tuesday. “Even with a big boost from tax reform, valuations are way too high. Volatility is lowest level EVER and should go higher.”

The Russell 2000, one of Wall Street’s widely-followed small cap equity indexes, has posted a healthy 13 percent climb this year.