Gaming may be a massive industry, but lately, shares of top video-game publishers have been struggling, so much so that CNBC’s Jim Cramer decided to dig deeper on Friday and find the source of the weakness.

Even with the triple tailwinds of the rise of the stay-at-home economy, the rise of e-sports and the rise of in-game transactions, shares of Activision Blizzard and Take-Two Interactive Software have been pummeled in recent weeks, losing 40 percent and 18 percent in value, respectively, since the end of September.

“Their stocks have both been tossed into the wood-chipper like Steve Buscemi near the end of Fargo,” the “Mad Money” host said, saying that the explanation for this “conundrum” was complicated.

In a nutshell, sales weakness at Activision Blizzard and fellow gaming player Electronic Arts has weighed on Take-Two’s shares as exchange-traded funds that package the video-game stocks together dragged the cohort lower, Cramer said.

“Something has gone wrong at Activision Blizzard, […] but the smaller, more nimble Take-Two is doing great and I think it’s insane that this stock has been hit so hard,” he said. “The market has clearly turned on the video game publishers and it’s painting with a very broad brush, but Take-Two’s doing great. I think you’re getting a terrific buying opportunity, and every time Take-Two gets dragged down by weakness at Activision or Electronic Arts, you know what I’d do? I’d just buy more.”

Cramer will be seeking out “man-made” buying opportunities for investors in the short week before Thanksgiving Day.

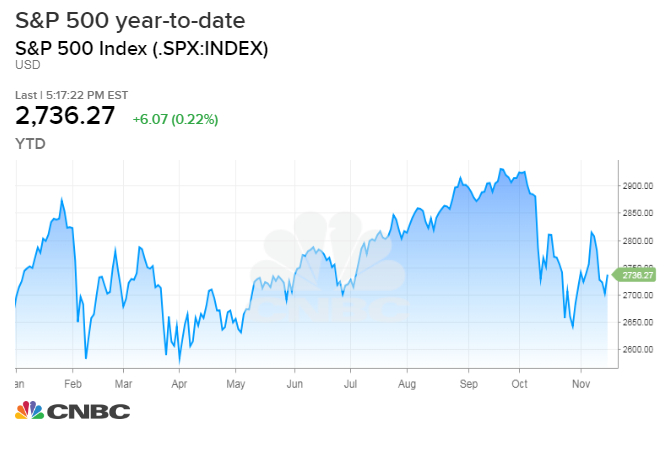

Some of these opportunities reared their heads Friday, he said. Federal Reserve Vice Chairman Richard Clarida told CNBC that the central bank should be more data-dependent and President Donald Trump said Chinese officials wanted to make a trade deal, both of which enabled stocks to pare their weekly losses.

“Immediately, there were questions about … the validity or the sincerity of both of these statements,” Cramer noted, referencing his own concern about the Fed’s lack of rigor in its policymaking.

He called Trump’s statement on China a “total wildcard,” noting the White House’s scramble to anonymously discredit the idea that they were close to making a new U.S.-China trade pact.

“Still, … if the Fed declares victory in the war against inflation, … and the president gets some substantive change from the Chinese, the market’s going to come roaring back,” Cramer said. “On the other hand, if the Fed keeps beating the economy over the head with a series of rate hikes and the president’s simply shining us on, then the industrials and the tech stocks will continue to get mauled by the bear.”

With that in mind, Cramer turned to his game plan for the week ahead, which includes key housing data and the last of the retail earnings reports. Click here for more.

Coca-Cola’s $5.1 billion acquisition of U.K. coffee chain Costa was less of an effort to take on giants like Starbucks than a move to create a new type of coffee experience, Coca-Cola President and CEO James Quincey tells CNBC.

To Quincey, who joined Cramer for an exclusive interview Friday, the coffee industry has split into three overarching parts: the “ready-to-drink piece,” the “at-home” segment and immediate consumption at coffee shops.

“The biggest piece is in immediate consumption channels. And, actually, while coffee shops exist, the biggest piece is the rest,” Quincey said on “Mad Money.” “Helping other customers have a store in a store and executing coffee within other people’s outlets is a big opportunity for them, and I think there’s a lot of white space to do a lot better around the world.”

Click here to watch and read more about his interview.

The breakdown in shares of Nvidia is a prime example of why investors should never fall in love with a stock, Cramer said Friday as shares of the chipmaker hovered near their 52-week lows.

The stock plunged as much as 19 percent after Nvidia’s third-quarter earnings report, which missed revenue estimates. Management’s guidance was also lower than expected, pressured by crimped profitability and excess inventory in its cryptocurrency mining business.

“What do you do with it right now? If you didn’t own Nvidia, it’s too soon to start buying it,” Cramer said of the company’s stock, which he used to own for his charitable trust. “There will be two more quarters of inventory problems.”

“If you do own it, I think you need to recognize that it’ll be a long time before this thing can come back. So if you can wait it out, you might want to if only because Nvidia still remains a great company and eventually they will get it right,” he added.

Click here for his full take.

In Cramer’s lightning round, he advised investors on their favorite stocks at lightning speed:

Visa Inc.: “You should buy the stock of Visa. [My charitable trust] almost did today. We almost pulled the trigger for ActionAlertsPlus.com.”

Tesla Inc.: “You know, I was at a Tesla store the other day and the cars are beautiful. Next.”

Questions for Cramer?

Call Cramer: 1-800-743-CNBCWant to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram – VineQuestions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com