Analysts are telling their clients to prepare for a long “bumpy” ride in the escalating trade conflict between China and the U.S.

The two major stock indexes in China have lost one-quarter of their value from highs this year. But it will take more than a bear market to get China to back down in its trade war with the U.S., according to Wall Street.

Wells Fargo explained last month Chinese stocks are falling this year due to escalating trade tensions with the U.S. and worries over the Asian country’s economic growth.

“The broader picture is what could happen to the economies, the bigger economic impact, and if we did go down that path of rapid escalation, that could affect Chinese economic growth which is currently on a path toward slowing,” global market strategist Peter Donisanu said on July 5.

On Monday, China’s Shanghai composite fell 1.3 percent, extending its losing streak to four consecutive trading sessions. The index is down about 18 percent so far this year compared to the S&P 500’s 6 percent gain. The Asian country’s benchmark is also down nearly 25 percent from its late January high.

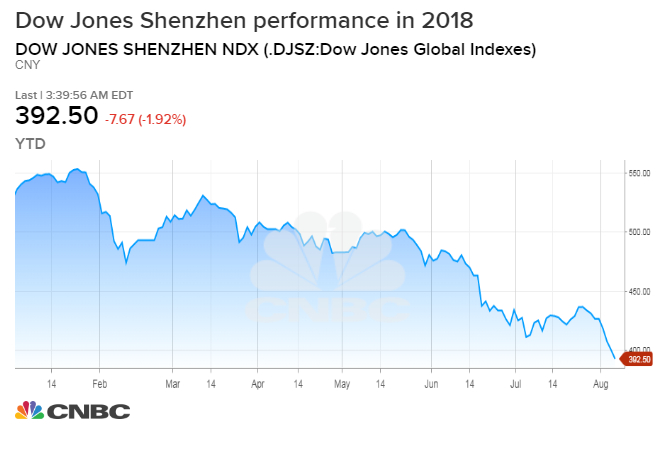

In similar fashion, the Dow Jones Shenzhen index is down about 26 percent year to date.

J.P. Morgan said China’s stock market will not rebound until the trade war is resolved.

“US-China trade tensions remains a big uncertainty and sentiment will likely remain cautious until there is further clarity on that front,” China equity strategist Haibin Zhu said in a note to clients Saturday.

The firm predicts China’s GDP growth rate will slow to 6.3 percent in the second half of 2018 versus 6.8 percent growth in the first half of the year.

Over the weekend President Donald Trump said the U.S. was winning in its trade war with China, citing the dramatic out performance of the domestic stock market versus the Asian country’s market.

“Tariffs are working far better than anyone ever anticipated. China market has dropped 27% in last 4 months, and they are talking to us. Our market is stronger than ever, and will go up dramatically when these horrible Trade Deals are successfully renegotiated. America First,” Trump said on Twitter Saturday.

It is not clear which Chinese index the President was citing for his 27 percent drop over the last four months comment.

So far in the trade war between the two largest economic powers in the world, the U.S. has slapped tariffs on $34 billion of Chinese products, which China met with retaliatory duties. On Wednesday Trump instructed U.S. Trade Representative Robert Lighthizer to consider raising proposed tariffs on $200 billion in Chinese goods to 25 percent from 10 percent. In response, China said on Friday it is preparing to retaliate with tariffs on about $60 billion worth of U.S. goods.

But Wall Street is not convinced China will buckle from the pressures of its falling stock market and increasing tariff threats.

Safanad’s chief investment officer, John Rutledge, argued that Chinese President Xi Jinping doesn’t face much political pressure from his country’s population. Earlier this year, China’s parliament passed a constitutional amendment that removes presidential term limits, enabling Jinping to stay in office indefinitely.

“Xi doesn’t give a hoot about the poor people in China. Why do you think they attacked soybeans? Not just because of our farmers, but because he doesn’t care about the pressure from his own people,” he said on CNBC Friday.

J.P. Morgan said the gulf between the two countries trade requirements will mean longer, more protracted negotiations.

“The gap between US’s demand list and China’s offer list is very large, and the back-and-forth of the negotiations in recent months suggests that neither side would make major concessions,” J.P. Morgan’s Zhu said. “Given the huge gap between the two sides, the outlook remains extremely unclear. Negotiations, even if resumed, will likely involve a bumpy and lengthy process.”

In similar fashion, Bank of America Merrill Lynch predicted the trade war will take some time to be resolved.

“At this point, both sides seem to be digging for a long fight,” the firm’s economist Helen Qiao said Friday.