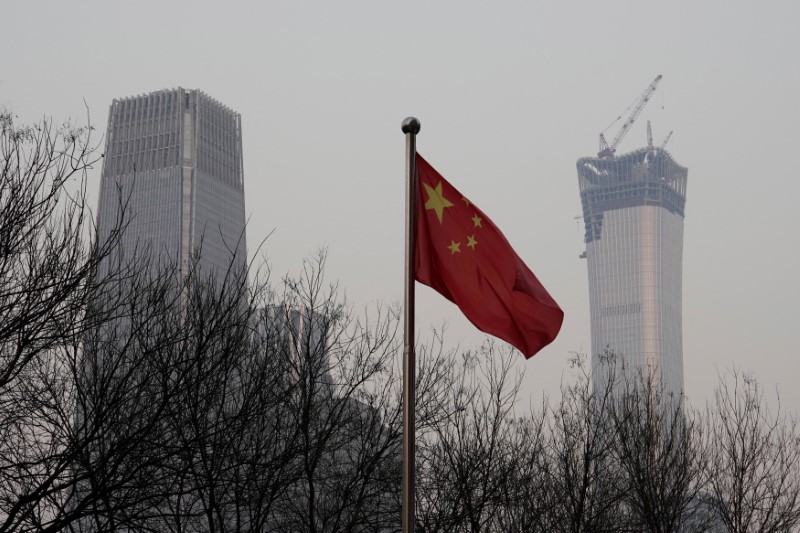

FILE PHOTO: China World Trade Center Tower III (L) and China Zun Tower under construction are pictured behind a Chinese flag in Beijing’s central business area, China December 14, 2017. REUTERS/Jason Lee

January 2, 2018

BEIJING (Reuters) – China’s central bank injected a net 212.36 billion yuan ($32.7 billion) into the financial system via short- and medium-term liquidity tools in December, rising sharply from November as it sought to ease tight cash conditions before the year-end.

In November, the People’s Bank of China only injected 4.74 billion yuan of funds into the financial system, amid a sustained crackdown on riskier lending to reduce financial risks.

On Dec. 14, the PBOC nudged money market interest rates upward just hours after the Federal Reserve raised the U.S. benchmark, as Beijing sought to prevent destabilizing capital outflows without hurting economic growth.

The PBOC said in a statement published on Tuesday that it lent 476 billion yuan to financial institutions via its medium-term lending facility (MLF) in December.

Outstanding MLF was 4.5215 trillion yuan at the end of December compared with 4.4205 trillion yuan at the end of November, implying a net injection of 101 billion yuan last month.

The PBOC also extended 134.06 billion yuan of loans to local financial institutions in December via its standing lending facility (SLF), it said.

The total outstanding amount of SLF loans was 130.42 billion yuan at the end of December, compared with 19.06 billion yuan a month earlier, implying a net injection of 111.36 billion yuan.

The PBOC uses the MLF and the SLF as tools for managing short- and medium-term liquidity in China’s banking system.

The central bank said on the last trading day of 2017 that it would let some commercial banks temporarily keep fewer required reserves to help them cope with the heavy demand for cash ahead of the Lunar New Year holiday, a step that analysts say does not signal any policy shift.

“The set-up of new liquidity facility is likely to add more than 2 trillion yuan into the banking system ahead of the upcoming Chinese New Year,” economists at OCBC Bank wrote in their research note.

“Together with the impact of targeted forward reserve ratio cut announced back in late September, which will take effect from 2018, we expect China’s liquidity situation is likely to improve in early 2018.”

(Reporting by Stella Qiu and Kevin Yao; Editing by Jacqueline Wong)