Corporate insiders could be barred from selling stock within a certain time period after share buybacks are announced, if one Democratic senator has his way.

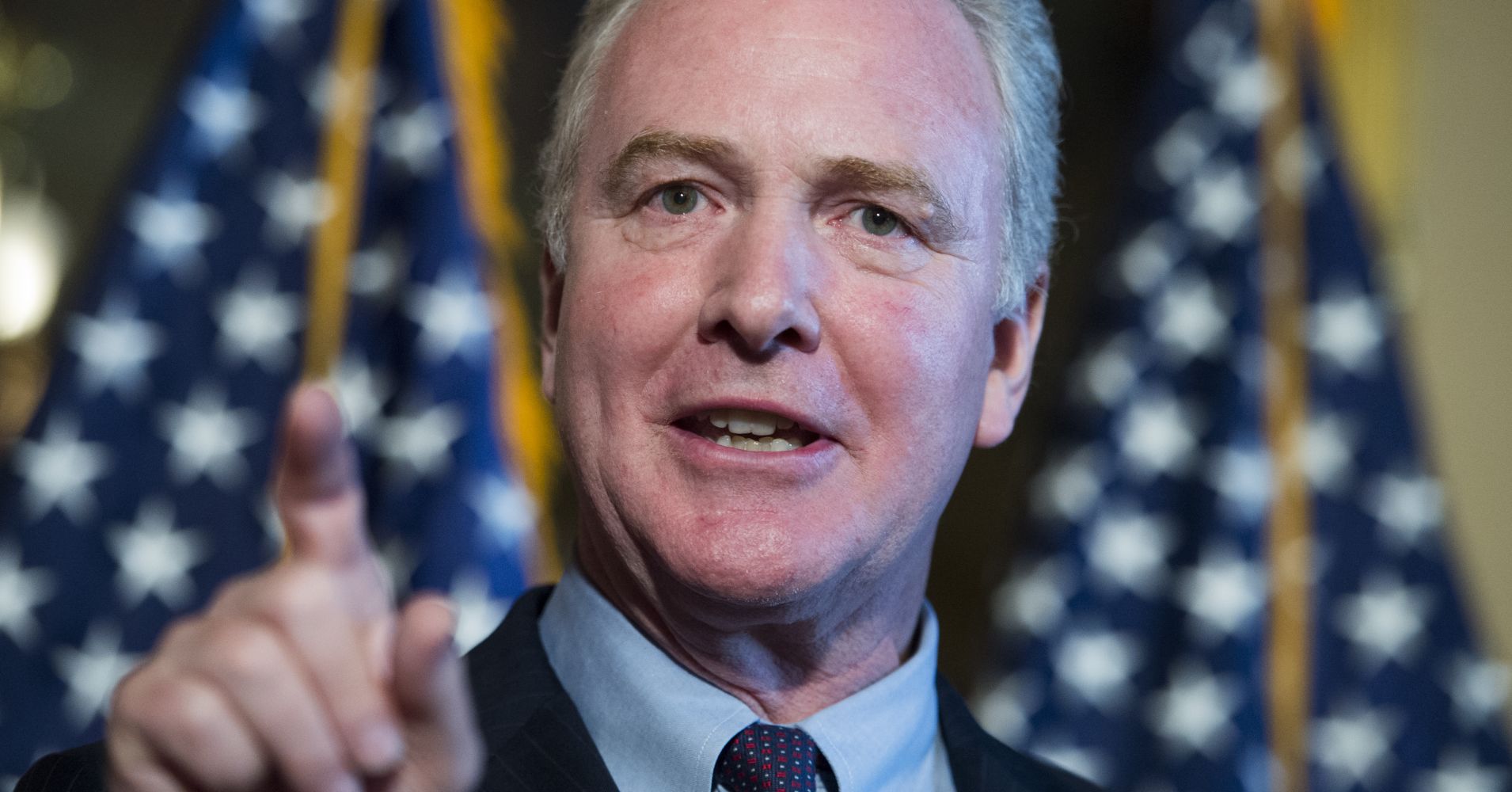

Sen. Chris Van Hollen of Maryland pointed to evidence from a Securities and Exchange Commission study indicating that share repurchases are benefiting corporate insiders at the expense of long-term investors.

As a result, he said he is preparing legislation that would direct the SEC to study the rule on buybacks, with hopes ultimately that a time frame can be established delineating the period during which sales would be prohibited.

“It could be a long period of time like several years, or maybe analysis would show another period of time that might be appropriate,” Van Hollen said during a media call.

The senator had asked the SEC to look into stock performance after buyback announcements to determine the impact on individual stocks. What the study found, as reported in a letter from Commissioner Robert L. Jackson Jr., was that “firms that let insiders sell on buyback announcements perform worse over the long run,” Van Hollen said.

“In other words, the executives’ gain is at the expense of the other stock holders who are not insiders,” he added. “It raises the concern that buybacks are used as a way to maximize executive pay.”

The senator’s comments come as share repurchases, announcements of which totaled more than $1 trillion in 2018, have come under bipartisan fire.

Earlier this year, Sens. Charles Schumer, a New York Democrat, and Bernie Sanders, a Vermont independent who is running for president on the Democratic ticket, unveiled a plan that would force companies engaging in repurchases to pay a living wage and provide health-care benefits.

Shortly after, Florida Republican Sen. Marco Rubio said he wanted to change tax laws that reward buybacks.

Jackson’s letter indicates that momentum may be building within the SEC to revisit the buyback rules. In the missive, the commissioner said he found that studying buybacks from January 2017 through the end of 2018 showed that insiders sell more stocks right after buyback announcements, indicating the repurchases are geared toward their enrichment rather than the benefit of the company.

“Whether insider sales cause the stock to fall or simply reflect insiders’ view that the buyback won’t add value in the long run, the opportunity to cash out stock-based pay gives executives reason to pursue buybacks that do not produce long-term value,” Jackson wrote.

The SEC declined comment on the matter. Jackson did not return a request for further comment.

Van Hollen indicated the next step is to reach out to the commission to get it to conduct a roundtable and hearing on the buybacks rule, and to use legislation to force it do so if necessary.

“I don’t know exactly what the appropriate period is, whether it’s a year, more than a year or less than a year” to restrict insider sales after buybacks, Van Hollen said.