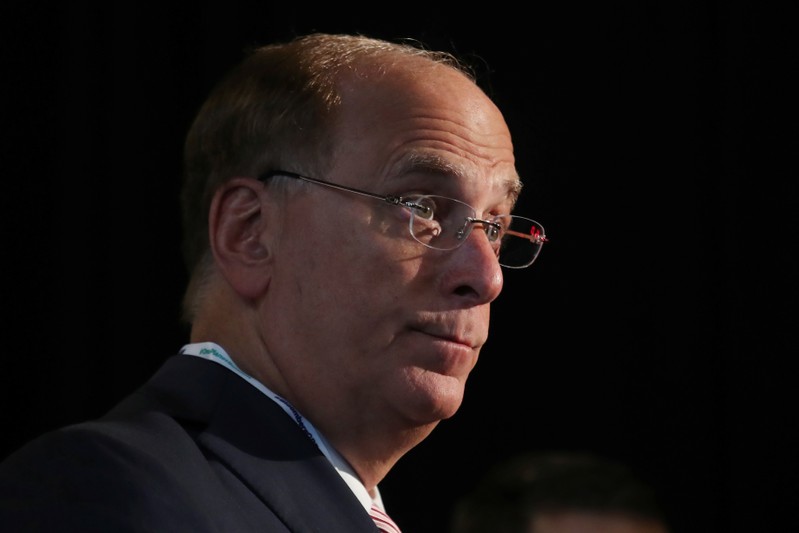

FILE PHOTO: Larry Fink, Chief Executive Officer of BlackRock, stands at the Bloomberg Global Business forum in New York, U.S., September 26, 2018. REUTERS/Shannon Stapleton/File Photo

April 2, 2019

By Trevor Hunnicutt

NEW YORK (Reuters) – BlackRock Inc, the world’s largest asset manager, has made changes to its senior leadership ranks aimed at winning more business from top institutional clients and boosting growth of its alternative investing business, according to a memo seen by Reuters on Tuesday.

BlackRock, with more than $6 trillion in assets under management, is giving primary responsibility for those institutional clients to executives in local regions.

It is also putting Edwin Conway in charge of BlackRock Alternative Investors, a group of complex investment products that Chief Executive Larry Fink thinks can amp up the company’s profits.

BlackRock, known best for funds that track the stock and bond markets, has been putting more emphasis on so-called illiquid alternative investments, complex investments including private equity and real estate that typically come with higher fees and are more likely to be sold to an institution than a mom-and-pop investor.

Conway, previously head of Blackrock’s institutional client business, will succeed David Blumer, who is becoming an adviser. The alternative group’s chairman is Mark Wiseman, one of several people tipped as Fink’s possible successors .

As part of the changes, Mark McCombe, another potential Fink successor, takes on a new role as chief client officer to work with global clients, including governments, financial companies and investment consultants that steer money from big clients, such as pension funds. Rob Fairbairn, who is already responsible for some top clients, becomes a vice chairman.

Fink, one of BlackRock’s founders in 1988, has neither signaled any intention to leave nor publicly named a successor. He told analysts last year that he thinks the alternative investments business can be a source of major growth for the company.

Asset managers have been squeezed by rising competition and pressure to reduce fees, and in recent months many have been cutting jobs and costs. Even BlackRock, which has benefited by offering low-cost exchange-traded funds, announced layoffs in January. At the time Fink pledged to continue investing in what he sees as growth opportunities.

The changes “show our commitment to constant reinvention and to the ongoing development of our senior leaders,” Fink and BlackRock President Rob Kapito wrote in the memo. “They are also designed to reinvigorate our approach at every level of the firm – and with every employee – at a critical time.”

Other changes announced on Tuesday included naming a new head of its Latin American business and corporate strategy. BlackRock elevated a new chief product officer, Patrick Olson, to a role that had been unfilled. Richard Prager, who runs the company’s trading and its lucrative operations lending out stocks, will retire. And Rick Rieder, a top BlackRock investor and global chief investment officer of fixed income, will be leading a “Global Allocation” team that picks investments across stocks, bonds and commodities.

(Reporting by Trevor Hunnicutt; Editing by Jennifer Ablan)