BlackRock strategists have turned increasingly bullish on U.S. stocks, raising them to overweight because fiscal stimulus is “supercharging U.S. earnings growth expectations.”

Kate Moore, BlackRock’s chief equity strategist, said that the firm thinks “the fundamental story is the best it’s been, which is surprising given how far we are into this cycle.”

Even though the market has retraced much of its February losses, BlackRock’s team believe the impact of tax law changes and company spending plans are still underappreciated by investors. They expect earnings growth and dividends to fuel returns, in a market that already has historically high valuations.

“We remain very constructive on equities in general,” said Moore. “The U.S. just got an injection of stimulus that no place else in the world did.” As a result, the strategists cut back their rating on Europe to neutral.

Moore said BlackRock has had a high overweight on stocks relative to fixed income, but the firm was waiting for the fourth quarter earnings period to get more tangible information on the impact of U.S. corporate tax cuts and stimulus.

“We were encouraged by the strong top line numbers going into the fourth quarter, but now they’re supercharged by the tax cut and fiscal stimulus,” she said. Earnings growth for the S&P 500 Index was 15 percent in the fourth quarter, and sales growth was the highest in six years.

Moore said analysts have been ratcheting up their earnings forecasts based on what companies said during earnings season. The expectation is that earnings growth this year could now be 19 percent. Sixty percent of S&P 500 companies provided guidance that exceeded expectations.

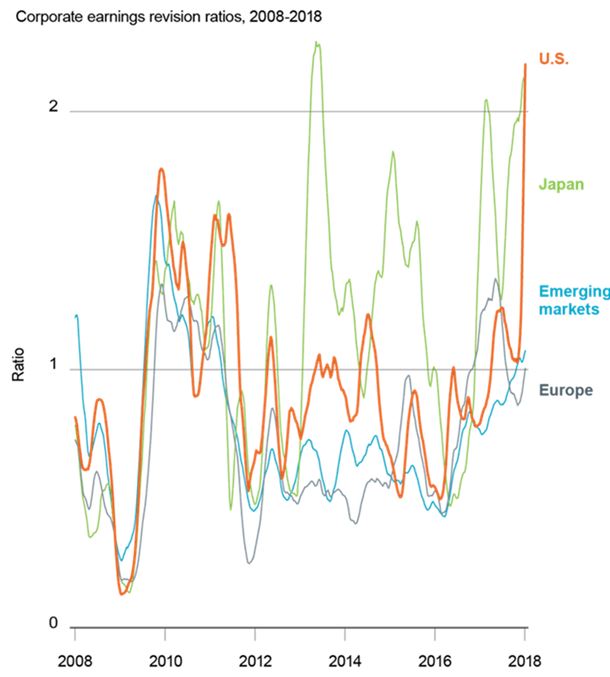

BlackRock monitors earnings revisions, which can be a key indicator for the market, and the percent of positive revisions is at a record pace. They are now running at a rate of two upgrades for every downgrade, or a ratio of 2. That ratio has averaged 0.8 based in the data which goes back to 1988, Moore said.

“What happened to the U.S. on the back of tax cuts and fiscal stimulus is something we’ve never observed,” she said. All regions are showing improvements in positive earnings revisions but nothing like the U.S. Europe also has solid earnings momentum but it lags the U.S., and higher revisions in Japan are “noisy.”

She added: “While we are really making this constructive call on the U.S., in the next three to six months we do recognize the pace of upgrades and the pace of earnings growth will likely slow. We will have to watch very closely…We are on a rocket ship at the moment.”

But Moore said the landing does not have to be messy. “It can take off with a bang. I don’t know if ends with a bang. Rockets can come down and land gracefully, if they’re well engineered,” she said.

Risks to the bull market are higher inflation and rising real rates, and for now the strategists said they see modestly higher inflation and gradually rising rates.

“This is a very different cycle, at a time when fundamentals are already solid,” said Moore. “We will have to be very vigilant and try to stay focused not just on what happens to earnings but as to what happens with inflation pressures, and the impact that could have on margins. The big risk is inflationary pressure eroding margins.”

Moore said her favorite sectors are technology and financials. Technology should gain from increased spending by corporations, benefiting from tax law changes. She said the other boosts to the market from tax law changes should be more corporate buybacks and acquisitions.

Source: BlackRock