Bitcoin futures will begin trading on the Cboe Futures Exchange on Sunday, following a huge ramp-up in the digital currency’s price.

The futures will launch at 6 p.m. New York time and will be trading under the ‘XBT’ ticker symbol. The launch will let institutional investors buy into the cryptocurrency space. Until now, bitcoin has been mostly owned and traded by a few entrepreneurs.

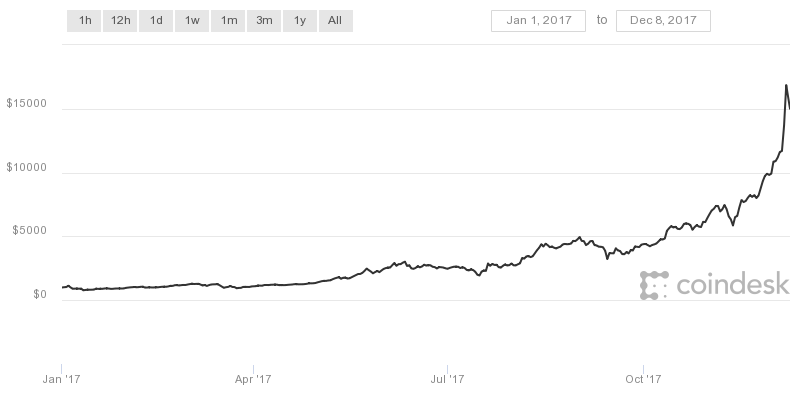

The cryptocurrency has become immensely popular this year, sending its price through the roof. In 2017 alone, bitcoin has shot up more than 1,000 percent. In the past month, the cryptocurrency is up more than $8,000 to trade at $14,950.06 on the Coinbase exchange shortly before the beginning of futures trading Sunday. It briefly broke above $19,000 on that exchange Thursday, before retreating.

“It’s going to be wild,” said Jon Najarian, co-founder of the Najarian Family Office and CNBC contributor, on “Halftime Report,” on Friday. The trader believes because there are so many isolated exchanges trading bitcoin itself around the world, it will confuse traders in the bitcoin futures used to securities with zero difference in price across exchanges and tight bid-ask spreads.

“There’ll be a natural arbitrage between those products as well as maybe 200 online exchanges,” Najarian added.

Bitcoin year to date

Source: CoinDesk

Cboe will base the price of bitcoin futures using the Gemini Trust Company, an exchange co-founded by the Winklevoss twins. One futures contract will be worth one bitcoin at the Cboe.

Bitcoin is one of the most volatile assets in the world right now rising and falling more than 20 percent at times in the span of a day. On Thursday, for example, bitcoin hit a high of $19,340 before falling more than 20 percent from that level. Such volatile trading — along with cybersecurity concerns and an association with criminal activity — has raised skepticism from major Wall Street institutions.

But launching bitcoin futures at the Cboe — one of the largest exchanges in the world — gives the digital currency some legitimacy it in the eyes of institutional investors. Bitcoin will also get a second dose of legitimacy after the CME Group launches its own bitcoin futures a week later. One CME bitcoin futures contract will be worth five bitcoins.

“The introduction of derivatives provides the necessary market structure for institutions to allocate to crypto-currencies,” which are short-term and long-term positives, according to Tom Lee, founder and head of research at Fundstrat Global Advisors. He also notes derivatives are “the first step to enable the creation of ETFs and other more liquid instruments.”