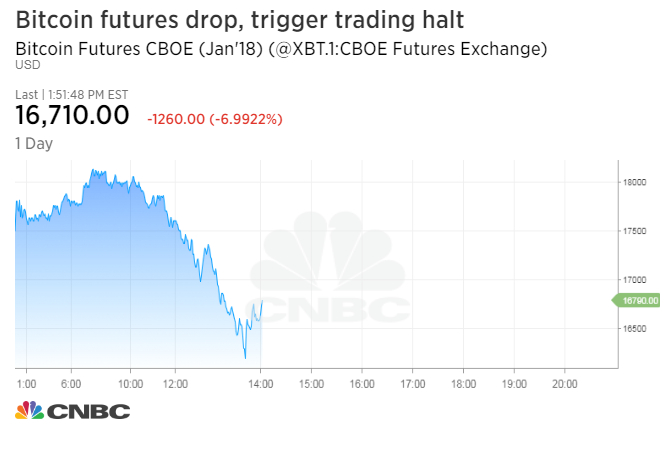

The Cboe‘s bitcoin futures fell 10 percent Wednesday, triggering a two-minute trading halt early Wednesday afternoon.

The futures had triggered trading halts twice in their Sunday night debut as the futures surged. On Wednesday, the futures, which expire in January, were down by more than 7 percent at $16,720 as of 2:02 p.m. New York time.

DoubleLine Capital CEO Jeffrey Gundlach said midday Wednesday on CNBC’s “Halftime Report” that “if you short bitcoin today, you’ll make money,” although he acknowledged it could trade higher in the short term.

The launch of bitcoin futures theoretically allows traders to short, or bet against bitcoin, by selling contracts. CME is set to launch its own bitcoin futures this coming Sunday.

Bitcoin itself fell 9.1 percent to session lows of $15,799.87, according to CoinDesk’s bitcoin price index. The digital currency was last trading near $16,307.

“I think there’s less [futures trading] volume today and yesterday than the first day,” Garrett See, CEO of DV Chain, the cryptocurrency trading affiliate of Chicago-based proprietary trading company DV Trading. “A lot of people traded on the first day out of the excitement of the launch.”

See attributed Wednesday’s afternoon decline in bitcoin and the bitcoin futures to profit taking. Bitcoin had soared more than 1,600 percent this year.