Amazon Prime Day is going to be big. Analysts are betting this year’s Prime Day will be the biggest ever, with the online shopping giant expected to bring in around $5.8 billion in sales this week, according to Coresight Research. Breaking previous Prime Day sales records should be easy because this is the first time it will run for a full two days.

Prime Day is key to Amazon’s business outlook because it allows the internet retail giant to promote millions of products and its Prime membership at $12.99 per month, or $119 annually. Membership includes free shipping perks, discounts at Whole Foods and access to streaming services Prime Video and Prime Music.

Amazon shares have been performing well ahead of Prime Day. The company’ stock, worth nearly a trillion dollars, has been positive nine of the last 10 days. Based on Prime Day history, Amazon stock may pass the trillion-dollar mark soon after Prime Day ends.

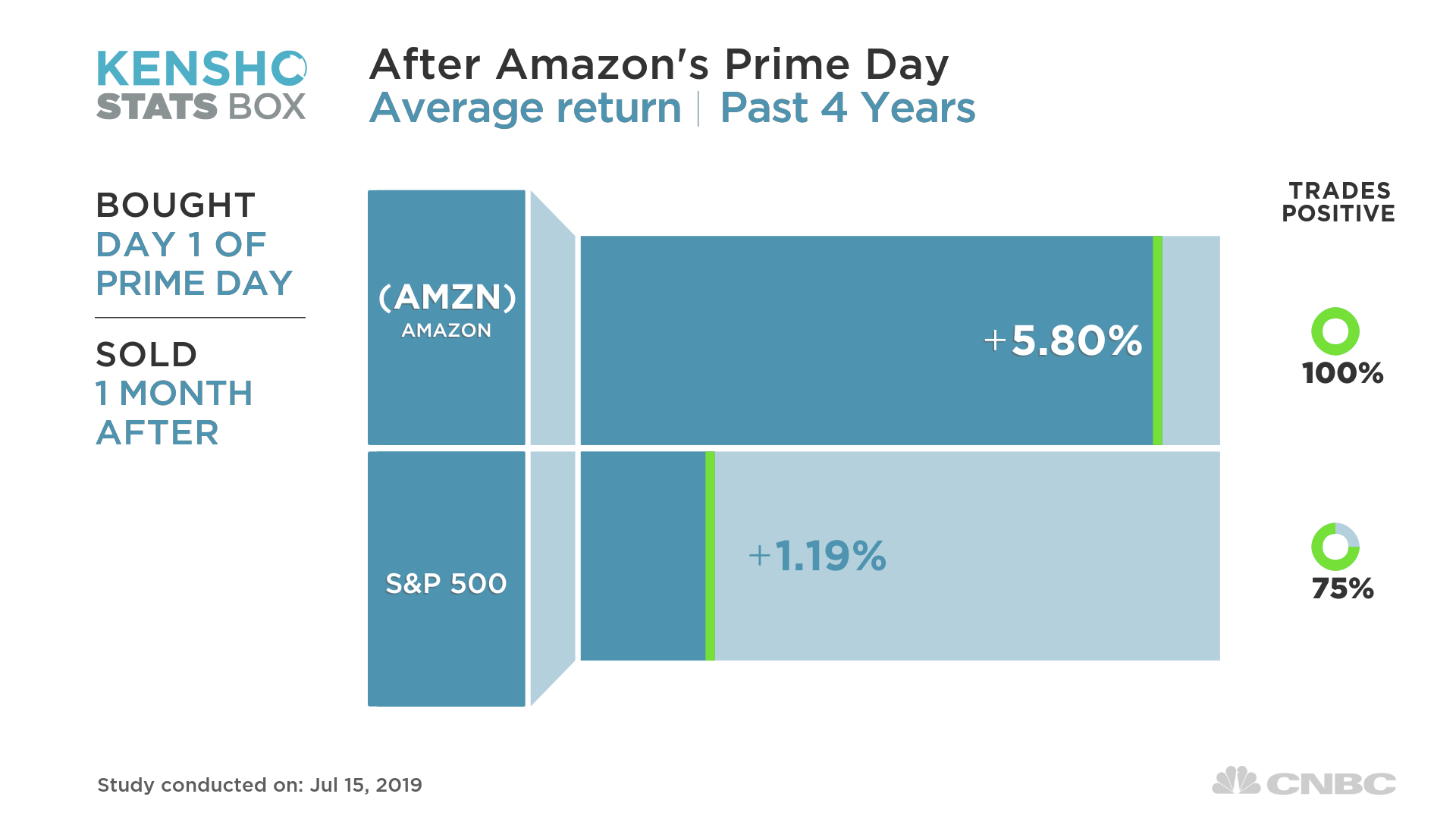

Since 2015, over the course of four previous Prime Day sales, shares of Amazon have traded higher 100% of the time in the month after, according to a CNBC analysis of data from Kensho, a machine-learning tool used by Wall Street banks and hedge funds to identify potential trading profits from historical market data. The stock has added an average of close to 6%, outpacing the S&P 500 return by a significant margin during the post-Prime Day period.

Investors also can make a broader bet the consumer sector will receive a boost through use of exchange-traded funds after Prime Day ends.

Todd Rosenbluth, CFRA’s senior director of ETF and mutual fund research, noted on CNBC Monday that Amazon shares are the largest holding in the Consumer Discretionary Select Sector SPDR (XLY). Amazon’s stock represents more than 23% of the XLY’s portfolio (more than double the next biggest holding by percentage weight), and the ETF is up 21% year to date and 5% in the last month.

Other retailers, including Target and Best Buy, try to compete with Amazon Prime Day, and Rosenbluth said a spike is seen in consumer discretionary after the event, based on historical data covering past Prime Days. Both of these retailers’ shares are XLY holdings, though at much smaller percentages than Amazon.