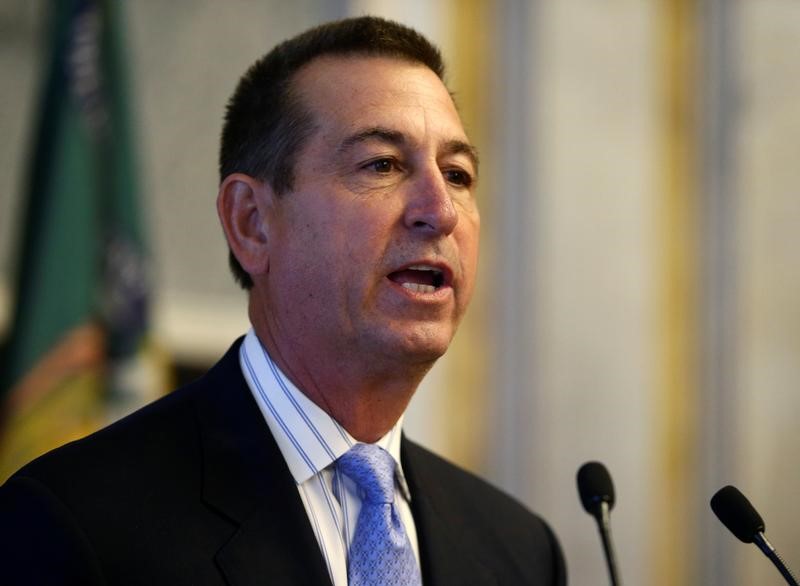

FILE PHOTO – Joseph M. Otting speaks after being sworn in as Comptroller of the Currency in Washington, U.S., November 27, 2017. REUTERS/Joshua Roberts

February 28, 2018

By Eleanor Duncan

LAS VEGAS (IFR) – Banks have the “right” to do the leveraged lending they want as long as it does not impair their “safety and soundness,” Joseph Otting, Comptroller of the Currency, said on Tuesday.

Otting was speaking to an audience at the ABS Vegas conference co-hosted by SFIG, in response to a question from the audience about whether the OCC would be more lenient with banks about leveraged lending.

The Government Accounting Office, the investigative arm of the US Congress, said last October that US bank guidelines on leveraged lending are subject to Congressional review, clearing the way for them to possibly be overturned.

The GAO said the guidelines, which critics said have hampered the leveraged debt market, are under the purview of the Congressional Review Act of 1996, which they would not be if the GAO had deemed them to be less formal instruments of policy.

“As long as banks have the capital, I am supportive of banks doing leveraged lending,” said Otting.

That stands even if leveraged lending activities transgresses guidelines, he said.

“When (the idea of the) guidance came out – it was like people were afraid to jump over the line without feeling the wrath of Khan from the regulators,” Otting said.

“But you have the right to do what you want as long as it does not impair safety and soundness. It’s not our position to challenge that.”

US regulators said they are open to revising restrictions on leveraged lending, offering an olive branch to a Republican-controlled Congress keen to roll back banking regulations. The response from regulators indicated a desire to avoid a protracted battle with a Congress.

Leveraged lending, which has been under intense regulatory scrutiny for the past four years, was not listed as a priority for the OCC in 2018.

The Comptroller of the Currency is the administrator of the federal banking system and chief officer of the OCC. The OCC supervises nearly 1,400 national banks, federal savings associations, and federal branches and agencies of foreign banks operating in the US.

(Reporting by Eleanor Duncan; Editing by Natalie Harrison and Jack Doran)