Bank of America reported third-quarter results on Friday that beat Wall Street expectations despite a slowdown in its fixed-income trading business.

Here’s how the company’s results fared against Wall Street expectations:

- EPS: 48 cents vs 45 cents forecast by Thomson Reuters

- Revenue: $22.079 billion vs $21.976 billion

The company’s stock rose 0.7 percent in the premarket following the release of the results.

“I think this was a fairly strong quarter for Bank of America here,” said Stephen Biggar, director of financial institutions research at Argus Research, on CNBC’s “Squawk Box.” “Loans were up 6 percent, not quite as high as [JPMorgan] reported yesterday, but margins did improve year over year, which is a very good sign.”

“Of course the one glaring weak spot was trading revenues,” Biggar said.

The bank also said, however, its fixed-income trading revenue fell 22 percent on a year-over-year basis. Third-quarter fixed-income revenue totaled $2.152 billion versus $2.646 billion in the year-earlier period. Bank of America said the slowdown was “driven by less favorable market conditions across credit-related products, as well as lower volatility in rates products.”

“This slowly grinding higher market is great for the asset-management businesses, but not so great for trading results,” Argus Research’s Biggar said.

JPMorgan Chase and Citigroup also reported sharp declines in quarterly fixed-income trading on Thursday.

Net interest income, a key metric for banks, totaled $11.4 billion, more than the $11.33 billion expected by StreetAccount and about the year-earlier period total of $10.429 billion.

Net charge-offs, a measure of costs for bad debt, increased by $12 billion on a year-over-year basis to $900 million, driven by higher commercial losses, the bank said.

Loans, meanwhile, totaled $927.1 million for the period, more than the expected $919.94 million. Deposits also topped consensus, coming in at $1.284 trillion. Analysts polled by StreetAccount expected deposits to total $1.273 trillion.

“Our focus on responsible growth and improving the way we serve customers and clients produced another quarter of strong results. Revenue across our four lines of business grew 4 percent, even with a challenging comparable quarter for trading,” Bank of America CEO Brian Moynihan said in a statement.

Bank of America’s consumer banking business saw revenue rise 10 percent to $8.8 billion, with loans rising 8 percent and deposits 9 percent.

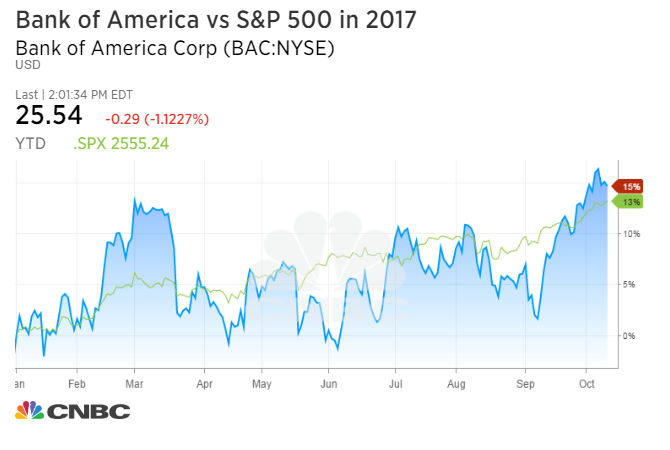

Shares of Bank of America have risen nearly 16 percent this year, slightly outperforming the S&P 500 index.

Analysts at Credit Suisse think the stock, along with that of other banking giants, could benefit from potential tax cuts and “progress on regulatory reform.”

“We’ll continue to assess valuations cognizant of the economic cycle, but equally as willing to embrace the changing operating environment, inclusive of the improved prospects for regulatory reform,” analyst Susan Roth Katzke said in a note to clients.

Last week, the Treasury Department released a white paper in which it recommends easing banking regulations.

Later Friday morning, Wells Fargo is expected to report earnings before the opening bell.