This year has been one of the best years for the stock market in history — and it’s not just U.S. stocks that have been rising. Equities around the world have been on a tear.

One of the markets that’s been doing particularly well is Japan, where stocks have seen an under-the-radar rally that’s recently accelerated since the landslide victory of Prime Minister Shinzo Abe.

Since Abe’s victory on Oct. 22, the benchmark Nikkei 225 jumped nearly 7 percent and now trades at its loftiest level in 25 years.

That’s caught the eye of investors, who, since the election, have added a combined $900 million to the two largest Japan ETFs, the $17.7 billion iShares MSCI Japan ETF (EWJ) and the $9.3 billion WisdomTree Japan Hedged Equity Fund (DXJ) — year-to-date the two ETFs still have combined outflows of $650 million.

More from ETF.com:

The 4 horsemen of stock ETFs

How a Latin American real estate ETF becomes a marijuana fund

Top volatility ETF takes a unique approach

The Nikkei hasn’t touched a record high since 1989, when it reached nearly 39,000 amid a ballooning asset price bubble in the country. Today the index is still well below that level, at 23,000, but some analysts say the rally in Japan’s stock market has much more room to run.

If that’s the case, EWJ and DXJ, which are up this year by 21.9 percent and 20.2 percent, respectively, could continue to outperform. For comparison, the SPDR S&P 500 ETF Trust (SPY), which tracks large-cap U.S. stocks, is up 17.5 percent so far in 2017.

YTD Returns For EWJ, DXJ, SPY

One of the analysts who has a bullish view on Japan is Jesper Koll, CEO of WisdomTree Japan. WisdomTree is the issuer of the second-largest Japan ETF, DXJ, and the fifth-largest Japan ETF, the WisdomTree Japan SmallCap Dividend Fund (DFJ).

In Koll’s view, sales for Japanese firms will easily grow faster than the consensus expectation, while the Japanese yen will be weaker than many anticipate, bolstering the bottom line for companies in the country.

“At the peak of the bubble economy in the 1980s, when the Nikkei was 40,000, you had earnings per share of $40. Now you have an EPS of $106, but the Nikkei is 21,000. You had this enormous multiple compression,” which has resulted in Japan trading at a discount to the United States, Koll explained in a recent podcast.

He said Japanese stocks are trading at 15.5-16x earnings, compared with U.S. stocks, which are trading at 20x.

“It’s very rare to see Japan trading at a discount,” he said. With the landslide victory for Prime Minister Abe, Koll noted it should become clear that “the growth momentum in Japan is going to be maintained; policy is not going to be tightened prematurely, and as a result of that, multiples can expand in Japan.”

Koll believes Japan’s TOPIX index can increase from the current levels around 18,000 up to 20,000, an increase of around 11 percent over the next six months.

“We maintain our bullish call for Japanese equities: Valuations are attractive, and positive earnings momentum is likely to keep going. Japan is not a “value trap.” In our view, profits can rise 25 percent in FY3/2018, which in turn suggest TOPIX at 2,000 is a reasonable fair-value target,” he wrote in a recent blog post.

While Koll likes Japanese stocks in general, he favors small-caps, which he says are much more focused on the domestic Japanese economy. In contrast, large-cap multinationals in Japan are much more dependent on exports to the United States and China.

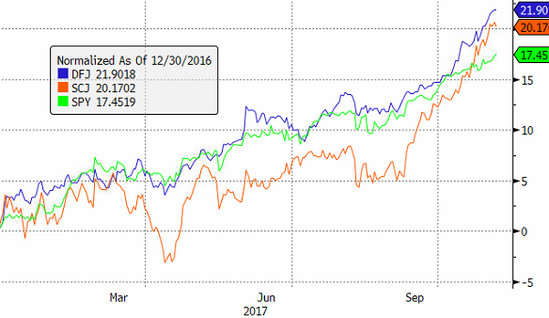

The WisdomTree Japan SmallCap Dividend Fund and the iShares MSCI Japan Small-Cap ETF (SCJ) gained about 27 percent apiece this year, outpacing their larger-cap counterparts.

YTD Returns For DFJ, SCJ

Underpinning Koll’s bullish view on Japanese stocks is his enthusiasm about the country’s economy, especially in light of Prime Minister Abe’s victory two weeks ago.

Following the election, Abe is ruling Japan with the backing of a two-thirds super-majority in parliament, making for a stable government. Both fiscal and monetary policy are expected to remain stimulative, with the Bank of Japan buying enormous amounts of government debt.

“For all intents and purposes, in Japan there is no difference between [monetary] and fiscal policies anymore,” Koll said.

He pointed out that the Japanese Treasury issues about $40 trillion yen per year, and the Bank of Japan buys about $80 trillion yen. Shockingly, the Bank of Japan owns about half the entire debt load of the Japanese government.

“This is something you don’t see in normal economies. In history you only observe this type of debt monetization during times of war,” Koll said.

It’s the reason many analysts believe the Japanese yen is poised to decline against the U.S. dollar.

According to Brad Bechtel, currency strategist at Jefferies, Abe’s victory is a green light for the dollar to move higher against the yen. He sees the USD/JPY exchange rate moving from current levels of around 114 to 118 in the first quarter of next year, before potentially rising more from there.

Not all analysts are bullish on the fortunes of Japan. Charles Sizemore, portfolio manager at Interactive Brokers Asset Management, sees it as a short-term trade at best.

“I view Japan as a potential short-term trade and not as a viable long-term investment,” he told U.S. News. “Over a period of months or even a few years, central bank stimulus can do wonders for stock prices, and that’s what you’re seeing in Japan today. The Bank of Japan actively buys broad-market Japanese ETFs, as for all intents and purposes they were running out of bonds to buy.”

Robert Johnson, CEO of The American College of Financial Services, agrees that the long-term prognosis for Japanese stocks is bearish.

“I would not put my money in Japan right now. The reason is that the demographics of the Japanese population are not favorable for long-term future stock market growth,” he said. “Simply put, the birth rate in Japan has declined considerably over the past 40 years. The result is, fewer consumers and fewer workers to fuel the economy, while the number of retirees is increasing dramatically.”

“Additionally, Japan is not a country that embraces immigration,” Johnson noted. “The long-term investment outlook for Japan is not positive.”

— By Sumit Roy, ETF.com

Contact Sumit Roy at roy@etf.com